- Hata

-

- JUser::_load: Unable to load user with id: 62

Financial

Financial  The Money Game: Bundesliga 2008/2009 Financial Results

The Money Game: Bundesliga 2008/2009 Financial Results

| The Money Game: Bundesliga 2008/2009 Financial Results |

|

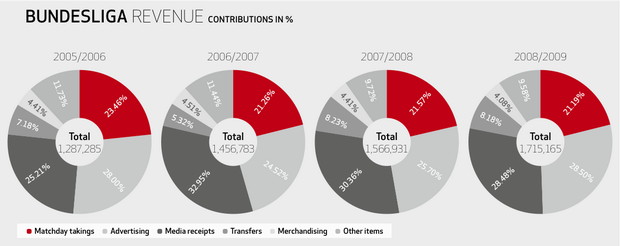

19 Eylül 2010 The DFL released a detailed report on the economic state of professional football in Germany on Wednesday. The financial results had previously been part of the DFL’s Bundesliga Report, due in August, but have now been released separately, earlier and in more detail. There is less text, more numbers and the glossy photos have been replaced by grittier bleached counterparts. The Bundesliga means business. What else is new? Increased revenue, increased equity, increased debt and Borussia Mönchengladbach bears the brunt of the blame. One thing you can do is adjust the revenue by subtracting one-off fees from transfers. This is what Deloitte like to do for their Football Money League and Annual Review of Football Finance. In this case revenues would have risen by €58,7m to €1.438bn in 2008, and by €136,9m to €1.575bn in 2009. The market leaders Bayern Munich more or less repeated their financial results from the previous season, so they didn’t contribute much to this increase. The deep cup runs by Bremen and Hamburg have contributed to record revenues for both clubs. Apart from that, a lot of the growth is probably also down to the newly promoted clubs. Cologne and Mönchengladbach alone have probably generated around €50m more than the likes of Rostock and Duisburg, and the Hoffenheim “fairy tale” has also helped this team to quickly attract a healthy mix of sponsors, while their new stadium will have also helped to drive up revenues. The potential relegation of clubs like Hertha can thus also have a negative impact on the league’s total revenue next season. Profitability

Equity and Debt

|

Degerli yazarimiz Pazar, 05 Ekim 2025.

YAZARIN DIGER YAZILARINI GORMEK ICIN TIKLAYIN

- Dünya Kupası: Şikeye karşı FIFA'dan sıkı önlemler (05 Mart 2014)

- Which country has the highest tax rate in the Soccer? (05 Mart 2014)

- Which country has the highest tax rate in the Soccer? (05 Mart 2014)

- Euro 2016 elemelerinde Türkiye, Hollanda ile aynı grupta (24 Şubat 2014)

- M. City model aldığı Barcelona'ya karşı (21 Şubat 2014)

- Fenerbahçe'nin Tahvil İhracına Koşullu izin (18 Şubat 2014)

- Fenerbahçe'nin Tahvil İhracına Koşullu izin (18 Şubat 2014)

- 19.Yüzyılda Futbol Nasıl Oynanıyordu? (18 Şubat 2014)

- Alex Brezilya'da Futbolcuları Greve Götürebilecek mi? (17 Şubat 2014)

- MPs demand football clubs allow far greater supporter involvement (17 Şubat 2014)

- MPs demand football clubs allow far greater supporter involvement (17 Şubat 2014)

- Fenerbahçe'den Yeni Forma Sponsorluk Sözleşmesi (13 Şubat 2014)

- Manchester City reported losses of £51.6m for 2012/13 (30 Ocak 2014)

- Manchester City reported losses of £51.6m for 2012/13 (30 Ocak 2014)

- Manchester City reported losses of £51.6m for 2012/13 (30 Ocak 2014)

- Premier League clubs dominates the international transfer market (30 Ocak 2014)

- Premier League clubs dominates the international transfer market (30 Ocak 2014)

- English clubs were by far world football's biggest spenders on overseas players in 2013 (30 Ocak 2014)

- English clubs were by far world football's biggest spenders on overseas players in 2013 (30 Ocak 2014)

- English clubs were by far world football's biggest spenders on overseas players in 2013 (30 Ocak 2014)

- Para Ligi'nde 2 Türk Takımı (24 Ocak 2014)

- Barcelona'da Kriz: Neymar Transferi İstifa Getirdi. (24 Ocak 2014)

- Barcelona'da Kriz: Neymar Transferi İstifa Getirdi. (24 Ocak 2014)

- A Transformation, Not a Transition, for Manchester United (21 Ocak 2014)

- A Transformation, Not a Transition, for Manchester United (21 Ocak 2014)

- Fenerbahce Boss Links Soccer Match-Fixing Case to Turkey Corruption Probe (21 Ocak 2014)

- Governments Must Do More to Fight Fixing, Say FIFA (21 Ocak 2014)

- Yargıtay Şike Davası'nda Aziz Yıldırım'ın Cezasını Onadı (17 Ocak 2014)

- Futbolda yükselen Arap sermayesi (17 Ocak 2014)

- Milan Eski Oyuncusu Seedorf'u Teknik Direktörlük Görevine Getirdi (17 Ocak 2014)

- Fenerbahçe Spor Kulübü'nün Faaliyet Raporu ve Borç Analizi (10 Ocak 2014)

- Fenerbahçe Spor Kulübü'nün Faaliyet Raporu ve Borç Analizi (10 Ocak 2014)

- Bayern Munich ready to take on Premier League for world domination (10 Ocak 2014)

- Financial Fair Play: Potential Challenges Under and Against the UEFA Regulations (07 Ocak 2014)

- Will Clubs be Banned for not Breaking-Even? A Review of Recent FFP Cases (07 Ocak 2014)

- Will Clubs be Banned for not Breaking-Even? A Review of Recent FFP Cases (07 Ocak 2014)

- Formalar Neden Boş kaldı? (03 Ocak 2014)

- Premier League: January transfer window 2014 - who needs what (03 Ocak 2014)

- Money Buys Soccer Teams, but Not Goals (03 Ocak 2014)

- Chelsea 2013'ü 49.4 Milyon Sterlin Zararla Kapattı (02 Ocak 2014)

- Chelsea 2013'ü 49.4 Milyon Sterlin Zararla Kapattı (02 Ocak 2014)

- Chelsea report £49.4m loss but meet Financial Fair Play rules (02 Ocak 2014)

- Chelsea report £49.4m loss but meet Financial Fair Play rules (02 Ocak 2014)

- Chelsea report £49.4m loss but meet Financial Fair Play rules (02 Ocak 2014)

- Premier League plays by government rules – with poverty wages for the rest (26 Aralık 2013)

- Premier League plays by government rules – with poverty wages for the rest (26 Aralık 2013)

- Para Kazandırmayan Şike, Şike Sayılır mı? (13 Aralık 2013)

- Champions League: Which teams have qualified for the last 16? (12 Aralık 2013)

- Top'un Hikayesi (11 Aralık 2013)

- David Moyes must figure fourth place is big ask for Manchester United (09 Aralık 2013)

- David Moyes must figure fourth place is big ask for Manchester United (09 Aralık 2013)

- Why Manchester United's Lack of Leadership on the Pitch Is to Blame This Season (07 Aralık 2013)

- BREZİLYA'DA GRUPLAR BELLİ OLDU (06 Aralık 2013)

- Fenerium 224 MilyonTL'na Futbol AŞ.'ne Satılıyor (06 Aralık 2013)

- Fenerium 224 MilyonTL'na Futbol AŞ.'ne Satılıyor (06 Aralık 2013)

- Would the Bundesliga really be better off without Bayern and Dortmund? (06 Aralık 2013)

- Would the Bundesliga really be better off without Bayern and Dortmund? (06 Aralık 2013)

- The rise and fall and rise of Borussia Dortmund and the Germany team (06 Aralık 2013)

- Top Deyip Geçmeyin! (05 Aralık 2013)

- SPOR KULÜPLERİ KANUN TASARISI TASLAĞI (28 Kasım 2013)

- Six arrests in football match-fixing investigation (28 Kasım 2013)

- Fenerbahçe Borç Arayışında (22 Kasım 2013)

- Türk Futbolu, Bir Futbol Bilgesini, Doğan Koloğlu'nu Kaybetti. (21 Kasım 2013)

- 2014 Dünya Kupasında Hangi Ülkeler Brezilya'ya Gidecek? (20 Kasım 2013)

- How Qatar became a football force: from Barcelona to PSG and World Cup (20 Kasım 2013)

- Futbol Anlayışımız (20 Kasım 2013)

- UEFA positive over 2012 club finances (28 Ekim 2013)

- UEFA positive over 2012 club finances (28 Ekim 2013)

- UEFA positive over 2012 club finances (28 Ekim 2013)

- State of the Game: Premier League now less than one third English (11 Ekim 2013)

- State of the Game: How UK's world football map has changed (10 Ekim 2013)

- Turkish soccer’s financial crisis potentially sharpens political divide (10 Ekim 2013)

- Turkish soccer’s financial crisis potentially sharpens political divide (10 Ekim 2013)

- Debt Dwarfing Manchester United Shows Turkish Soccer Rot (08 Ekim 2013)

- Futbolda Kurumsal Yönetime Doğru Kurumsal Sosyal Sorumluluk (04 Ekim 2013)

- Fifa must consult over Qatar World Cup switch, says Richard Scudamore (04 Ekim 2013)

- Dünya Kupası Kışın Mı Oynanacak? (04 Ekim 2013)

- Dünya Kupası'nın Karanlık Yüzü (03 Ekim 2013)

- Manchester United Liverpool'un Geçmişteki hatalarını mı Tekrarlıyor? (03 Ekim 2013)

- Monaco have plenty of money and ambition but not many supporters (23 Eylül 2013)

- Monaco have plenty of money and ambition but not many supporters (23 Eylül 2013)

- Manchester United spent £71m in 2012-13 financing debt of takeover (23 Eylül 2013)

- Manchester United spent £71m in 2012-13 financing debt of takeover (23 Eylül 2013)

- Manchester United spent £71m in 2012-13 financing debt of takeover (23 Eylül 2013)

- How to read the UEFA ranking (17 Eylül 2013)

- Türkiye'ye UEFA'dan Puan Darbesi (17 Eylül 2013)

- Gareth Bale: What the transfer means for Real Madrid (16 Eylül 2013)

- Gareth Bale: What the transfer means for Real Madrid (16 Eylül 2013)

- Kulüplerde Gelirler Arttı, Borçlar ve Zararlar da! (13 Eylül 2013)

- Kulüplerde Gelirler Arttı, Borçlar ve Zararlar da! (13 Eylül 2013)

- BBC Price of Football 2013 Revealed (13 Eylül 2013)

- Artık İddaa Gelirlerine Haciz Konulabilecek (05 Eylül 2013)

- Artık İddaa Gelirlerine Haciz Konulabilecek (05 Eylül 2013)

- Galatasaray'ın rakipleri Real Madrid, Juventus, Kopenhag (02 Eylül 2013)

- Uluslararası Tahkim Mahkemesi CAS Fenerbahçe'nin 2 Sezonluk Cezasını Onayladı (29 Ağustos 2013)

- How Uefa's seeding system helps Arsenal & Hinders Celtic (28 Ağustos 2013)

- How Uefa's seeding system helps Arsenal & Hinders Celtic (28 Ağustos 2013)

- TFF yeni futbol disiplin talimatını kabul etti (07 Ağustos 2013)

- Payments to 2012/13 Europa League clubs (24 Temmuz 2013)

- Payments to 2012/13 Europa League clubs (24 Temmuz 2013)

Son Yayınlananlar

- Aston Villa'nın Premier Lig'in Kârlılık Ve Sürdürülebilirelik Kurallarıyla Başı Dertte!

- Premier Lig'de Genç Oyuncu Gelişimini Piyasa Dinamikleri mi Belirliyor?

- Galatasaray'ın Liverpool Zaferi: Taktik ve Kurumsal Analiz

- Futbolda Sermayenin Artan Kontrolü Oyun Kültürüne Zarar Vermeye Devam Ediyor!

- Juventus Gelirlerini Artırıp Zararını Azalttı Ama Kulüpte Hala Finansal Kırılganlık Devam Ediyor!

- Futbolda Şiddet ve Başarısızlık İlişkisi

- Servet Transferleri ve Futboldaki Kolonyalizm

- Yorumcu

- Futbol Dünyasından Filistin’e Destek

- Mourinho'nun Gidişi, Ali Koç'un Çöküşü: Bir İktidarın Psikolojik Analizi

Yazarlarımızın Son Yazıları

Kimler Sitede

Şu anda 1418 konuk çevrimiçiİstatistikler

İçerik Tıklama Görünümü : 52748475|

Yazılarınızı info@futbolekonomi.com adresine gönderebilirsiniz. |